Ratings Methodology for Factoring Companies

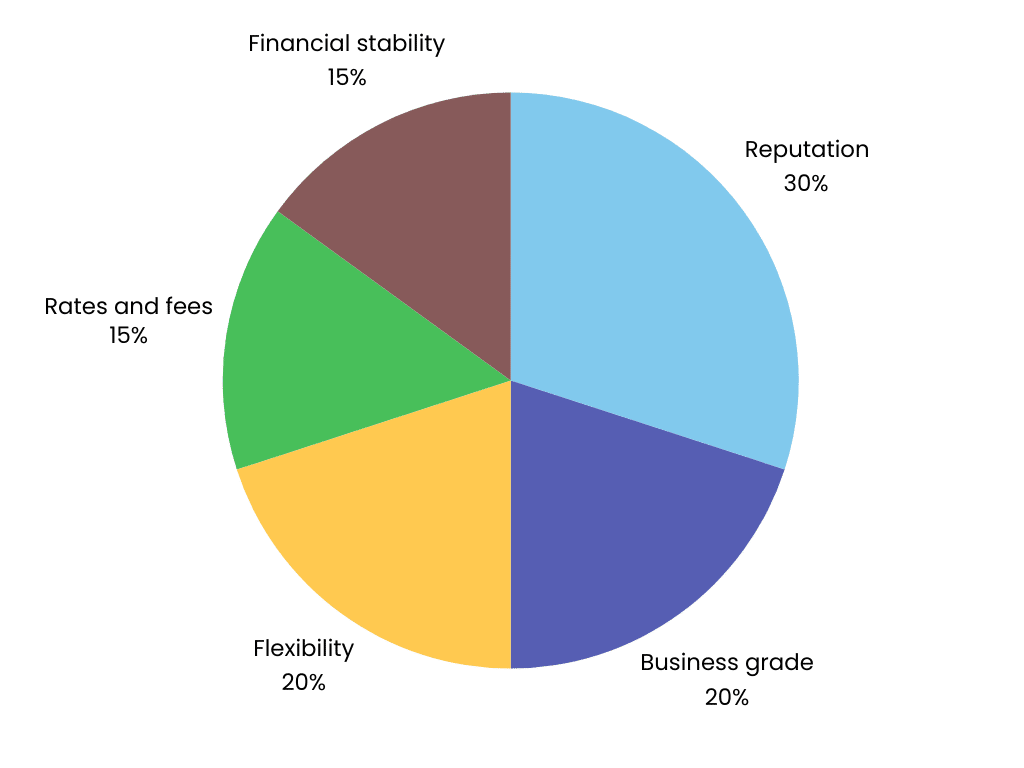

Truck Factoring Review’s overall ratings for factoring companies are evaluated against five major categories. A raw score is produced for each of the following:

- Reputation: 30%

- Business grade: 20%

- Flexibility: 20%

- Rates and fees: 15%

- Financial stability: 15%

Data collection and review process

TFR reviewed five of the most popular factoring companies

based on online search volume. Some of these companies are TFR partners, but this does not influence the review process.

We collect information from the factoring companies

and verify it through interviews and on company websites. We also use public review sites and business data collectors/providers.

Then, we rate the companies

on a scale of 1 to 5 on the following criteria: reputation, business grade, flexibility, rates/fees, and financial stability. Each category constitutes a portion of the lender’s overall score. These scores generate ratings from 1 star (poor) to 5 stars (excellent). We then use the weighted categories to calculate a score for each company. We divide that score by 5 and multiply it by 10 for our final score.

The review team

TFR selects partners based on the findings of our independent reviewers. TFR does not publish reviews or assessments at the direction of any company and our partners cannot pay us for a favorable review or rating. If you have any questions about a company mentioned on our site, including our partners, feel free to contact us.

Reputation (30%)

This category is determined by public reviews and membership to the International Factoring Association (IFA). A public reviews rating between 4.5 and 5 equals a category score of 5, 4 through 4.5 equals 4, 3.5 through 4 equals 3, 3 through 3.5 equals 2, and anything less than 3 equals 1. Then we deduct 1 point for non-membership in the IFA. This gives us a final score between 1 and 5.

Business grade (20%)

This category is derived from a business analysis conducted by the go-to-site for official business complaints. It takes into account each company’s grade, the presence or absence of accreditation, and the number of complaints filed. We start each company at a score from 1 to 5 based on their letter grade: 5 for A+, 4 for A, 3 for B, 2 for C, and 1 for D. Then we subtract 1 point for the absence of accreditation and 1 point if the number of complaints filed in the last 12 months is greater than 10. This gives us a final score between 1 and 5.

Flexibility (20%)

This category considers contract length, the availability of same-day funding options, minimum volume requirements, and whether carriers have the choice to select the invoices they want to factor. We start each company at a score of 5 and subtract 1 point for a long-term contract, absence of same-day funding, minimum volume requirements, and the inability to factor select invoices. This gives us a final score between 1 and 5.

Rates and fees (15%)

This category evaluates the competitiveness of rates and any additional fees charged by each company, beyond the factoring rate. We start each company at a score of 5 and subtract 1 point for minimum rates above 3% and 1 point for any additional fees above $5 (not including optional wire transfers or special services). This gives us a final score between 1 and 5.

Financial stability (15%)

This category relies on credit reports sourced from a corporation that exclusively provides business credit reports, not consumer ones. Companies receive a score of 5 for a low-risk credit rating, a 4 for a moderate risk credit rating, and a 3 for a high risk credit rating. This gives us a final score between 1 and 5.

Discretionary (not weighted)

A company can earn a higher score if it offers superior and convenient technology solutions. Unique features or services that few others provide, as well as recognition as a top provider by industry leaders, can also contribute to higher scores.

If you have any feedback or questions, please don’t hesitate to contact us here.